SPH

2024.11.11

328

Pets have transformed from family companions to essential members of many households. This change has led pet owners to invest more in their pets’ well-being, with a focus on nutrition, healthcare, daily essentials, and entertainment. In this article, we will provide an in-depth analysis based on the latest research reports, focusing on the trends in the global pet industry size, pet food, supplies, healthcare, and e-commerce sectors.

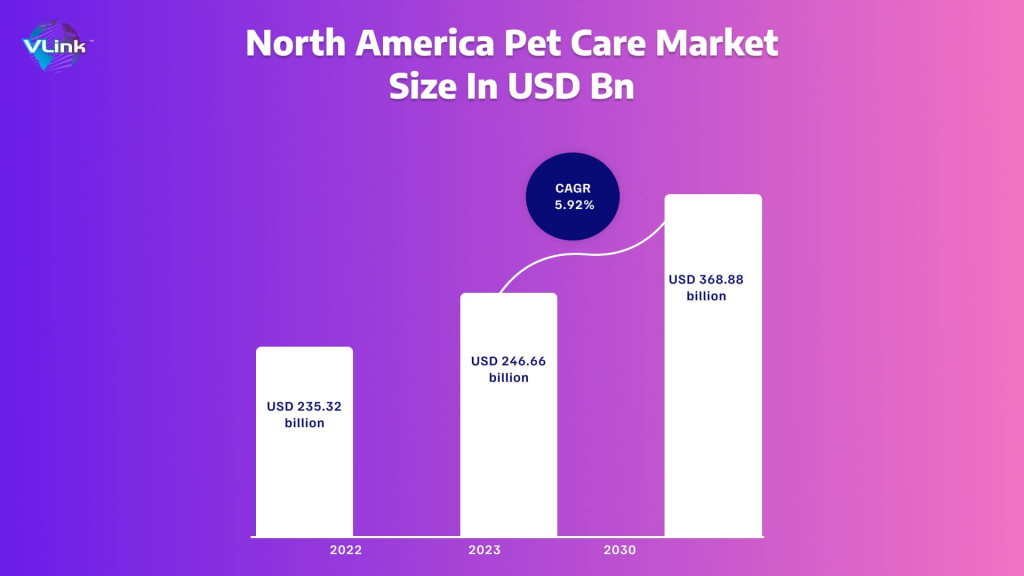

The latest report from the World Animal Foundation highlights a remarkable trend: even during economic downturns, the pet industry remains resilient and continues to thrive. According to the report, the global pet industry is projected to grow significantly, from $246.66 billion in 2023 to an impressive $368.88 billion by 2030. This substantial growth reflects the unwavering bond between pets and their owners and the increasing demand for innovative pet products and services.

Furthermore, data from Vinkinfo underscores that this growth trajectory is fueled by a compound annual growth rate (CAGR) of 5.92% from 2023 to 2030.

Source: Vlinkinfo

This consistent rise is attributed to factors such as the growing adoption of pets worldwide, advancements in pet technology, and the expansion of the pet wellness market. As pet owners continue to prioritize the health, comfort, and happiness of their furry companions, the pet industry shows no signs of slowing down.

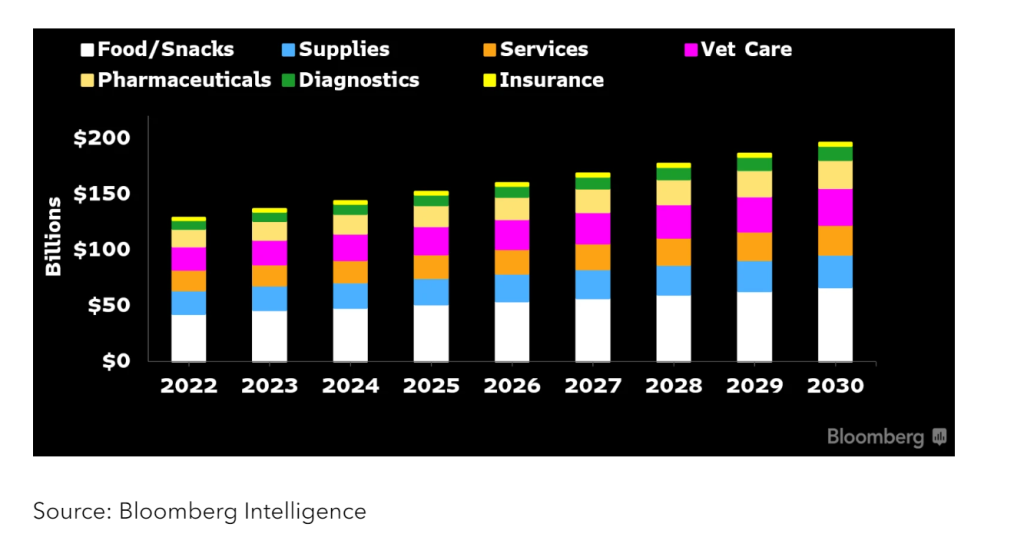

Pet food has consistently led the growth of the pet economy, as it represents the largest expenditure in pet care. According to BI’s projections:

Diana Rosero-Pena, a Bloomberg Intelligence Consumer Staples Analyst, highlighted in the global pet industry forecast report: “We’re seeing a profound increase in consumer spending on pets and expect this trend to continue through 2030. Consumers are willing to pay more for items for their pets, with the pet food market having the potential to grow by more than 50% from current levels by the end of the decade.”

Source: Bloomberg Intelligence

It is projected that:

In terms of pet food formats, as consumers become increasingly aware of pet health and wellness, the market for fresh/frozen pet food is expected to expand significantly in the coming years:

Additionally, the report highlights an increase in the “stickiness” of the pet food market. One key driver of this growth is that, despite inflation and other economic pressures, pet owners remain loyal to their pets’ dietary needs. In other words, pet owners are unlikely to change their pets’ food habits, regardless of rising product costs.

It is also noteworthy that, as pet food is the largest part of pet-related expenses, its limited elasticity allows suppliers to pass on higher costs to consumers more easily.

Currently, the U.S. remains the largest market for the pet industry, with Europe holding about a third of the market share.

However, according to BI’s forecast, expansion in other regions could accelerate, especially in emerging markets like China. With a significant increase in pet ownership, China’s pet industry is likely to experience larger-scale growth:

In recent years, driven by the rapid rise in pet ownership and a shift in Chinese families’ perceptions of pets, the urban pet market in China has surged. For most urban pet owners, pets are no longer seen just as household animals but as their “furry children,” with the new generation of pet owners being more willing to spend on their beloved pets.

Despite challenges such as limited new pet ownership and economic pressures, BI’s ceanalysis reveals:

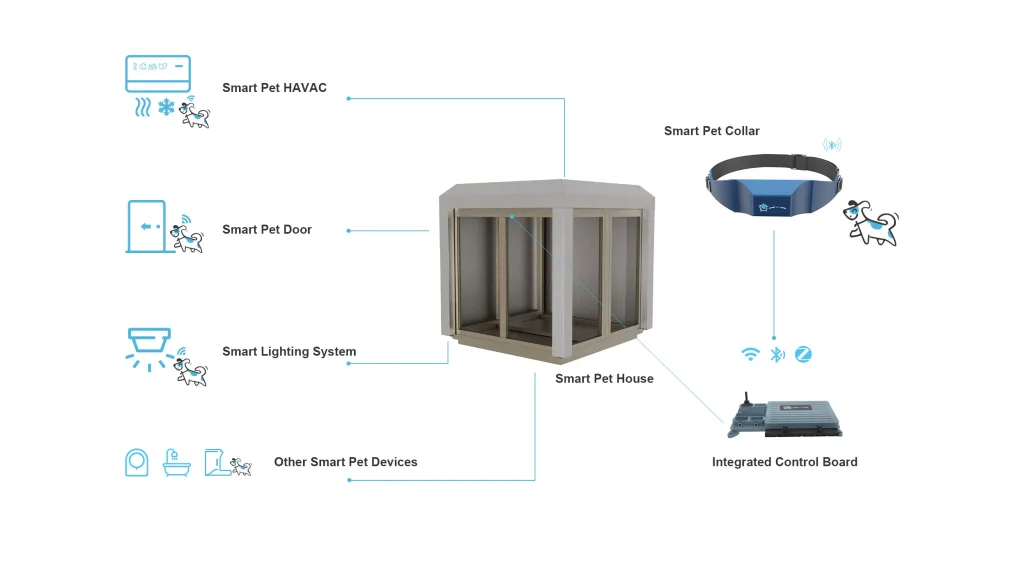

Among pet products, smart pet houses have emerged as a promising niche market. As pet owners increasingly demand better living environments for their pets, high-tech products like SPH’s smart pet house systems are becoming a focal point. These innovative pet houses not only offer comfortable living spaces but also feature smart systems that automatically adjust temperature and humidity, while syncing with smart collars worn by pets to provide a personalized living experience.

Although pet products generally account for a smaller share of retailers’ revenue (around 30%), their profit margins are higher. SPH’s smart pet houses and related smart systems, with their high added value and intelligent features, are becoming key drivers of profit growth.

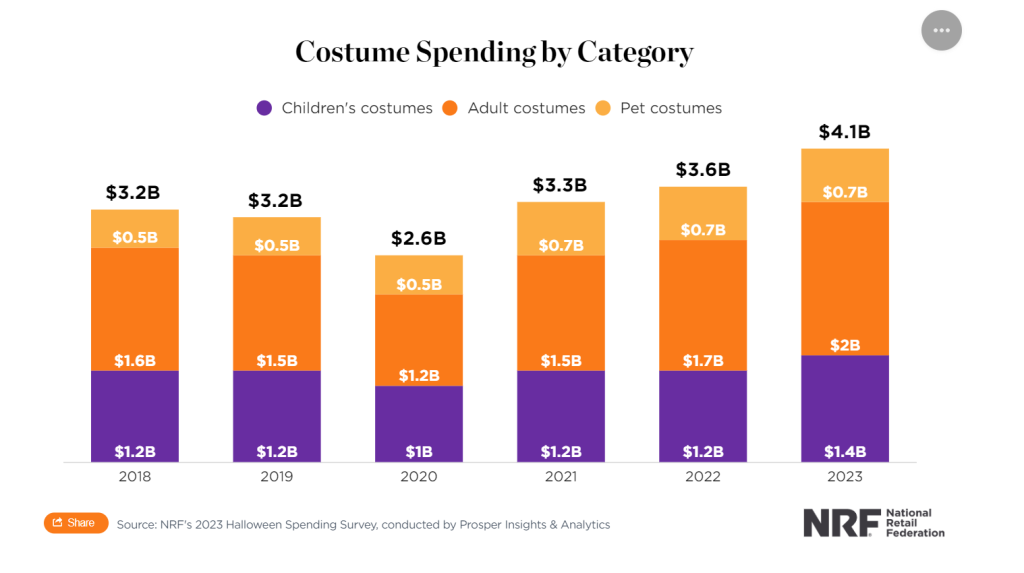

For example, BI’s report highlights that brands such as Gucci, H&M, and Tommy Hilfiger have launched pet clothing lines to cater to pet owners’ fashion needs. Similarly, the combination of smart pet houses and luxury brands is becoming a new trend. According to data from the National Retail Federation (NRF), the U.S. pet costume market for Halloween 2023 reached $700 million, and Circana reports that more than three-quarters of the U.S. pet costume market is dominated by private label brands.

Source: NRF, 2018-2023

U.S. Halloween Costume Spending by Category

This trend reflects the broader movement of pet humanization, where pet owners are increasingly willing to spend more on luxury and high-tech products for their pets. As owners treat pets more like family members, smart pet products (such as SPH’s innovative smart pet house) are becoming increasingly popular. These houses not only offer a comfortable space but also provide advanced features such as temperature control and personalized living experiences, akin to the attention pet owners give to pet fashion.

With innovative products like SPH’s smart pet houses, pet owners can provide their pets with both a comfortable living space and the convenience of smart technology. This trend is expected to further drive the growth of the pet products market in the future.

Due to favorable demographics, consumer spending, and the growing concern of pet owners about their pets’ health, BI research estimates that:

By 2030, revenue in the pet pharmaceutical sector will rise from the current $16 billion to over $24 billion.

This growth is also driven by the increasing number of companies applying advancements from human healthcare to pet health, including the development of new therapies. Innovations in areas such as pain management, oncology, and cardiology are expected to lead to breakthroughs and high-demand products.

Andrew Galler, BI’s Global Healthcare Chief Analyst, stated:

“The development of new therapies and advanced diagnostic tools will not only enhance the quality of care but also drive significant economic value. As pets live longer, the demand for sophisticated healthcare solutions will continue to rise.”

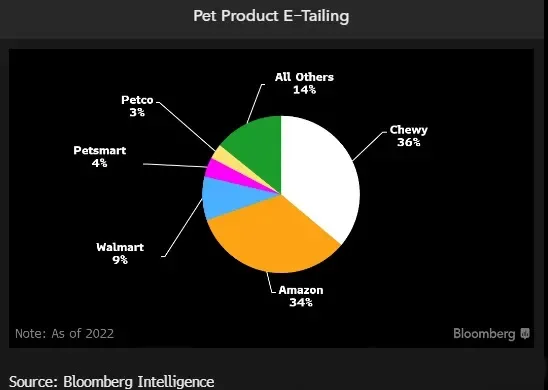

Online shopping has brought more convenience and options to consumers, driving the continued rise in e-commerce adoption within the pet industry. BI projects:

This growth is fueled by increased investment from digital-native pet retailers like Chewy, who are striving to provide a “seamless” experience to capture more market share.

While e-commerce holds significant potential, BI anticipates:

Even so, driven by increased online shopping, pet e-commerce will continue to grow faster than the overall pet market.

According to previous BI surveys, competitive pricing and free shipping are the two biggest factors driving consumers to shop online. Among consumers who have already switched to online shopping, convenience is seen as a key motivator to continue.

It’s not just Chewy leading the pet e-commerce space. BI’s research shows that Amazon, along with brick-and-mortar retailers like Petco, PetSmart, and Walmart, are expanding their offerings in this sector as well.

Source: Bloomberg Intelligence

Although e-commerce is rapidly gaining ground, brick-and-mortar stores still dominate in the U.S., with their biggest appeal being one-stop shopping. Retail giants like Target and Walmart offer a vast array of products, from human and pet food to home goods and personal care items.

According to a BI survey conducted by Attest in January 2023:

As the global pet industry continues to grow, fierce competition between online e-commerce platforms and physical stores is expected to persist, with both vying for greater market share.

1874 S Upham Street Lakewood CO 80232 US

+1(321) 437-2859

Chris Liu

+1(321) 437-2859